Pricing American options

:: Numerical solution ::

- We need to ensure that the derivative price does not fall under the payoff - that would be an arbitrage.

- We know:

- The price of a European call option on a stock which does not pay dividends lies above the payoff.

- The price of a European call option on a stock which pays dividends always crosses the payoff.

- The price of a European put (regardless of whether the stock pays dividends or not) always crosses thepayoff.

- Therefore: For an American call on a stock that does not pay dividends and an American put on an arbitraty stock, the price is different from their European counterpart.

- The derivative price smoothly pastes to the payoff - theorem from the lectures

- From the lectures - algorithm for a call option:

- Formulation in terms of a free boundary problem.

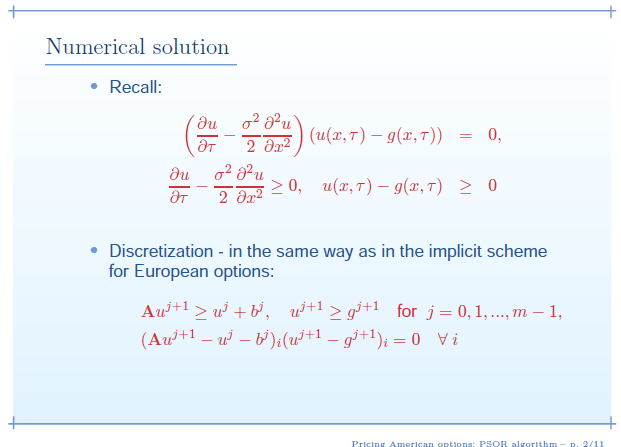

- Transformation to a linear complementarity problem (on a fixed domain - for all positive stock prices)

- The same sequence of transformations as in the case of a Europea option (there we obtained a heat equation)

- We continue:

- Discretization:

- Numerical scheme for solving the discrete problem:

- Discretization:

:: Comparison of numerical pricing: European vs. American option ::

European option - algorithm for the transformed function u- We compute the boundary conditions and insert them into the solution matrix.

- We compute the initial condition and insert it into the solution matrix.

- Computation of the next time level - SOR method:

- Initial approximation: we can take the values from the previous time level

- Condition for stopping the iterations - norm of the residue

- Computation of a new iteration using the SOR method - we repeat until the condition for stopping the iteration is not satisfied, the we move to the next time level

- We compute the boundary conditions. The solution has to lie above the transformed payoff => we compute max(boundary condition, transformed payoff) and insert it into the solution matrix.

- We compute the initial condition and insert it into the solution matrix.

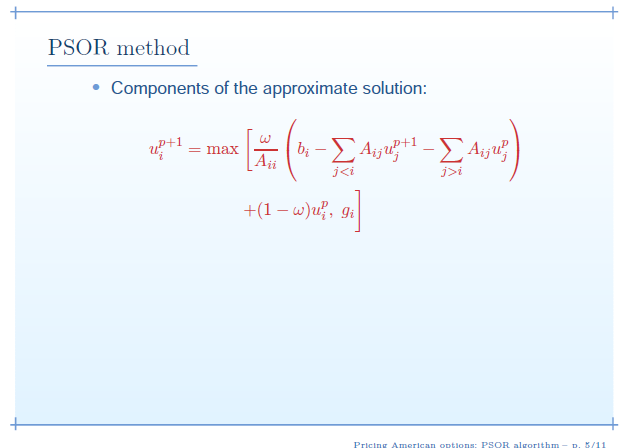

- Computation of the next time level - - PSOR method (projected SOR method)

- Initial approximation - we want one that is close to solution, so that we do not have to compute many iterations: we compare the values from the previous time level with the transformed payoff => we take max(previous time level, transformed payoff)

- Condition for stopping the iterations - norm of a residue cannot be used, since we do not compute a solution to a system of equations, we use the difference of two subsequent iterations

- Computation of a new iteration using the PSOR method - we compute the i-th elemts of the vector using SOR method and compare it with the transformed payoff => we take max(SOR iteration, transformed payoff) and compute the next element - we repeat until the condition for stopping the iteration is not satisfied, the we move to the next time level

:: Exercise ::

Implement the algorithm above.

:: Practice problems ::

- How does the algorithm change for put option?

-

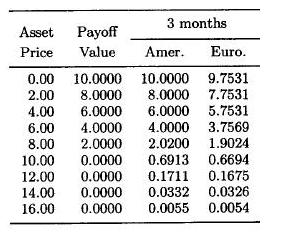

The stock price S follows a geometrical Brownian motion with parameters

=0.20,

=0.20,  =0.40. The stock does not pay dividends. Interest rate equals 10 percent. Compute the price of a put option with expiration in half a year and exercise pirce 10 USD for the following stock pricces: 0, 2, 4, 6, 8, 10, 12, 14, 16

USD. Give the results to 4 decimal places.

=0.40. The stock does not pay dividends. Interest rate equals 10 percent. Compute the price of a put option with expiration in half a year and exercise pirce 10 USD for the following stock pricces: 0, 2, 4, 6, 8, 10, 12, 14, 16

USD. Give the results to 4 decimal places.

Belowe are the results for an option with expiration in 3 months (the remaining parameters are the same); they can be useful when testing the parameters of the numerical schemes and method for computing the option prices for those stock values which are not grid points.

Financial derivatives - exercises, 2014

Beáta Stehlíková, FMFI UK Bratislava

E-mail: stehlikova@pc2.iam.fmph.uniba.sk

Web: http://pc2.iam.fmph.uniba.sk/institute/stehlikova/

Beáta Stehlíková, FMFI UK Bratislava

E-mail: stehlikova@pc2.iam.fmph.uniba.sk

Web: http://pc2.iam.fmph.uniba.sk/institute/stehlikova/