Random processes I.

Wiener process, Brownian motion, GBM

:: Stochastic character of financial variables ::

-

From the trajectories of stock prices (also other financial variables - interest rate, exchange rates, etc.) we see that it cannot be described by a deterministic function. Therefore, stochastic processes are used in the modelling. .

-

Left: trend (stock price, 5 years time frame), right: fluctuations (stock price, time frame of a couple of hours)

Source: http://finance.google.com

Source: http://finance.google.com

:: Wiener process and Brownian motion ::

| Download [ex02processes.sce] - Scilab file with the code shown below; we will write more |

-

The basic process, used to derive more complicated ones, is a Wienerov proces. Recall its definition:

Random process {W(t), tIn what follow, we done a Wiener process by w. 0} is called a Wiener process, if

0} is called a Wiener process, if

- the increments

W(t+

) - W(t) have a normal distribution with zero expected value and variance equal to

) - W(t) have a normal distribution with zero expected value and variance equal to  ,

,

- for every partition 0 = t0

t1

t1  ...

...  tn, the increments

Wti+1 - Wti nare independent random variables, with distribution given in the previous points ,

tn, the increments

Wti+1 - Wti nare independent random variables, with distribution given in the previous points ,

- W(0)=0,

- trajectories are continuous.

- the increments

W(t+

-

How to obtain a sample path (trajectory) of a Wiener process

- We will generate an approximation - values at discrete points of the form (time, value of the process) which we join by line segments.

- The times will be 0,

,2

,2 , . . ., where

, . . ., where  is a sufficiently small time step.

is a sufficiently small time step.

- Value at time 0 is equal to 0.

- Increment on the interval [k

, (k + 1)

, (k + 1) ] is a random variable with zero expected value and variance equal to

] is a random variable with zero expected value and variance equal to  .

.

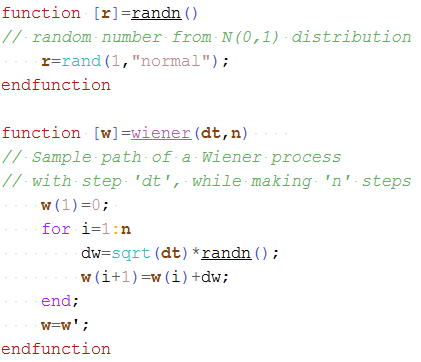

In Scilab we firstly define auxiliary functions:

Now we can plot a trajectory:

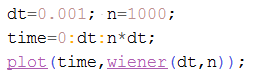

Plot several trajectories of a Wiener process into one plot. A sample output:

-

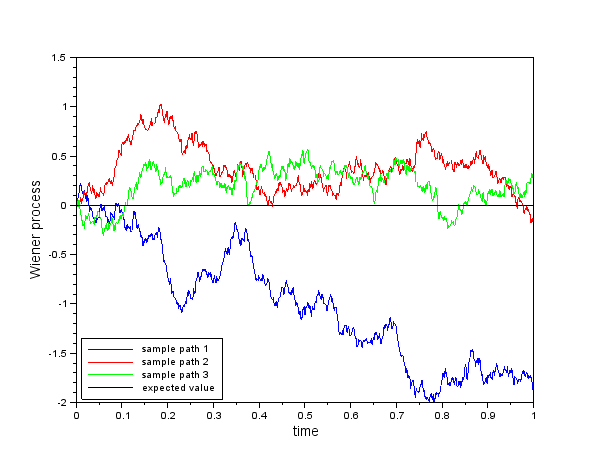

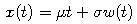

By adding a linear trend to a multiple of a Wiener process:

we obtain a process which is known as a Brownian motion.

If the parameter

is zero, the resulting graph is a line. For a nonzero value of

is zero, the resulting graph is a line. For a nonzero value of  , there are random fluctuations added to this linear trend.

, there are random fluctuations added to this linear trend.

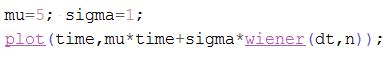

In Scilab - for example:

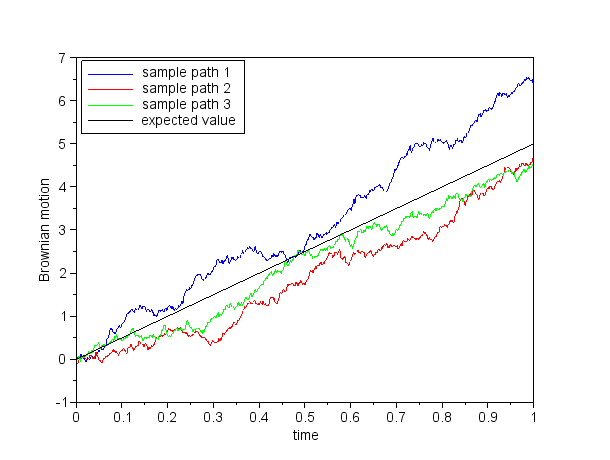

Plot several trajectories of a Wiener process into one plot and add the expected value. A sample output:

:: Exercises (1) ::

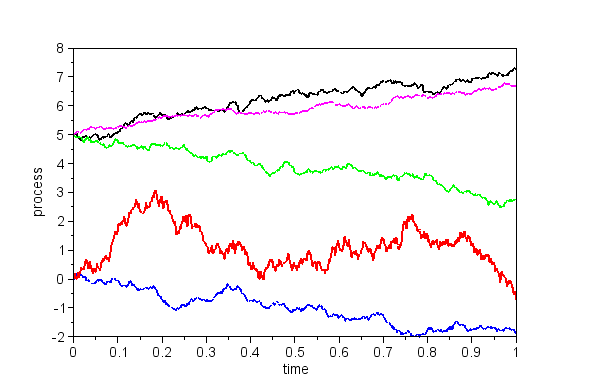

- Modify parameters of a Brownian motion and note the influence on typical trajectories. Then, add the processes

- x1(t)=w(t)

- x2(t)=3*w(t)

- x3(t)=5+2*t+w(t)

- x4(t)=5+2*t+0.5*w(t)

- x5(t)=5-3*t+w(t)

:: Geometric Brownian motion ::

-

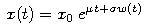

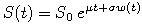

Geometric Brownian motion is defined as:

where x0 is the value of the process at time 0.

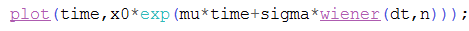

- Simulating in Scilab:

-

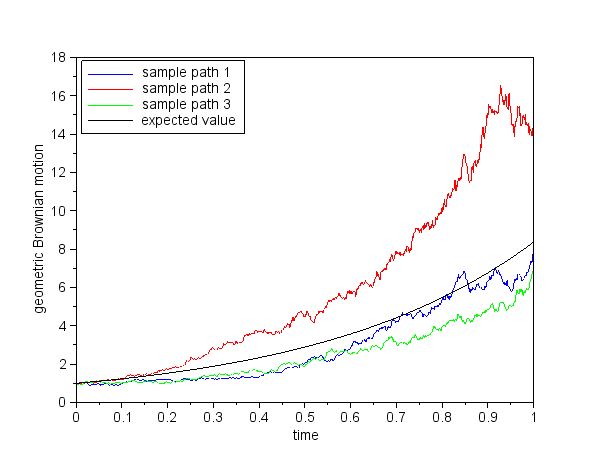

Sample paths of a geometric Brownian motion:

Make a similar plot.

:: Modelling stock prices by mean of a geometric Brownian motion ::

-

GBM as a model for the stock price S:

-

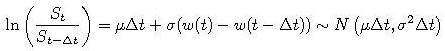

Recall from the lecture: If the stock price S follows a GBM, then for the returns we have

hence the returns are independent random variables with the distribution given above.

:: Exercises (2) ::

Recall from the probability course the definition and basic properties of a lognormal distribution:- Random variable X has a lognormal distribution, if its logarithm ln(X) has a normal distribution

.

.

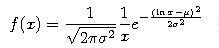

- Probability density function of a lognormal random variable X is given by

(for positive x, otherwise it is zero)

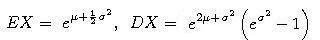

- Expected value and variance of a random variable X with lognormal distribution are given by

| Download [ex02stock.sce] - Scilab file with an outline of solution to the following problems and some useful functions |

Suppose that the stock price follows a GBM with parameters

= 0.30,

= 0.30,

= 0.25

and that its current price is 150 USD.

= 0.25

and that its current price is 150 USD.

- Plot the probability density function of the stock price in one month. To check your computation, compare it with a histogram of simulated values of the stock price in one month.

- Compute the probability that the price in one month will be lower than 140 USD?

- What it expected value of the 1/4-year return? What is the probability of this return to be negative?

:: Estimating the parameters of the GBM from stock prices ::

| Download [amzn.txt] and [ex02data.sce] - stock price data in text file and Scilab file with the code given below and the outline of estimation |

How to obtain estimates of parameters - we use the procedure from the lecture (cf. the slides) and replicate the results

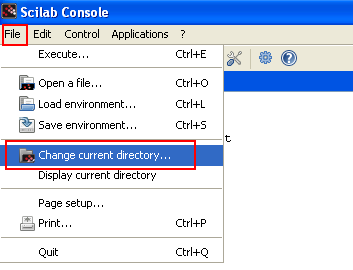

- Firstly, set the working directory, so that it contains the data.

- Read the data to Scilab. These are daily data, so we set the value of the variable dt, measuring the length of a time step in years, to 1/252.

- We define the returns - we create a vector of returns v using the formula above

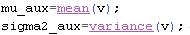

- We know that these returns have a normal distribution. Furthermore, we know that the expected value of a normal distribution is estimated by a sample mean and the variance is estimated by a sample variance.

Therefore we compute the mean and the sample variance of the value in vector v - these will be estimates of the quantities

and

and

- Finally, we compute the estimates of the parameters

and

and  :

:

:: Practice problems ::

-

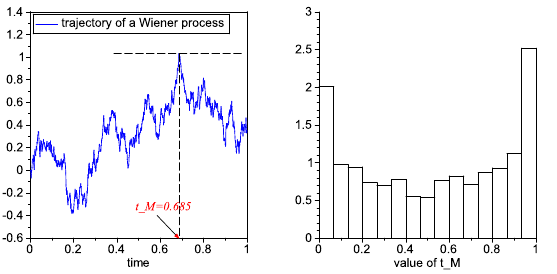

Denote by tM the time, in which the sample path of the Wiener process achieved its maximum on

the time interval [0, 1] Plot a histogram by simulating the realizations of the random variable tM.

A trajectory of a Wiener process and corresponding value of tM is shown below, together with a sample histogram.

- Let w be a Wiener process; define B(t) = w(t) - t w(1) for time t in interval [0, 1]. It is known as Brownian bridge.

- Plot some sample paths of the process and explain its name.

- Compute its variance at time t and sketch its behaviour as a function of time. To check your computation - what does the result have to be for t=0 and t=1?

- More practice problems in the course notes

Financial derivatives, 2014

Beáta Stehlíková, FMFI UK Bratislava

E-mail: stehlikova@pc2.iam.fmph.uniba.sk

Web: http://www.iam.fmph.uniba.sk/institute/stehlikova/

Beáta Stehlíková, FMFI UK Bratislava

E-mail: stehlikova@pc2.iam.fmph.uniba.sk

Web: http://www.iam.fmph.uniba.sk/institute/stehlikova/