Black-Scholes model: implied volatility

:: Implied volatility ::

- Implied volatility is the value of volatility

which, after substituting into the Black-Scholes formula, gives the market value of the option.

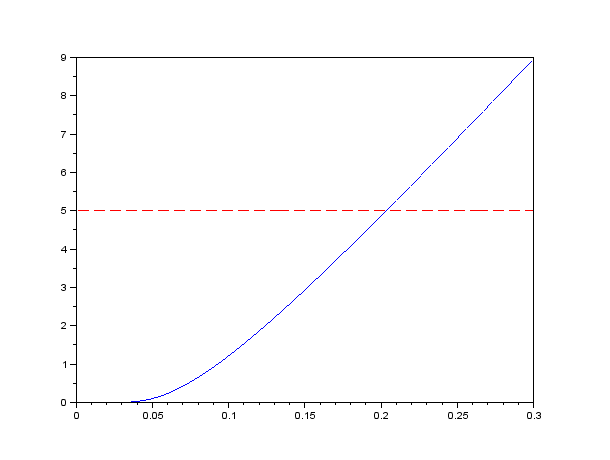

- Dependence of the call option price on the stock volatility:

- The call option price is an increasing function of the volatility.

- As the volatility approaches zero, the limit of the price is max(0,S-E*exp(-r

)).

)).

- As the voltility approaches infinity, the option price approaches the stock value S

- Hence, if the market price of an option is from the interval (max(0,S-E*exp(-r

)),S), then the implied volatility exists and it is unique.

)),S), then the implied volatility exists and it is unique.

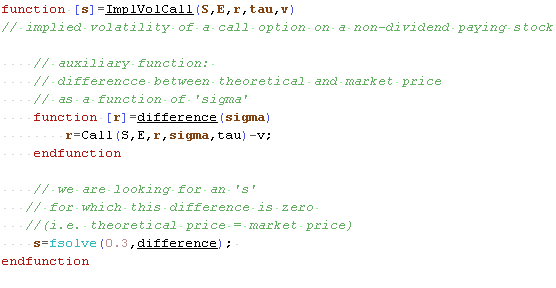

- There are several ways of implementing computation of implied volatility; here is one of them:

What does it do:

- Scilab function ImplVolCall is a part of the file black_scholes.sci given with the previous topic.

:: Exercises ::

- Modify the graph above - use a wider rage of volatility on the horizontal axis, so that the limit at infinity can be observed.

- Choose the parameters values which show both possible beginnings of the curve (when stock price approaches zero).

- Try the computation of the implied volatility for a given option - this is important; we will need it when studying so called Leland model.

:: Practice problems ::

- Implied volatility for other options - derive its existence and uniqueness, write a script implementing its computation for the given data and use it to compute the implied volatility for selecte parameters:

- put option written on a stock that does not pay dividends

- call a put options on a stock that pays continuous dividends with continuous dividend rate q

Financial derivatives - exercises, 2014

Beáta Stehlíková, FMFI UK Bratislava

E-mail: stehlikova@pc2.iam.fmph.uniba.sk

Web: http://www.iam.fmph.uniba.sk/institute/stehlikova/

Beáta Stehlíková, FMFI UK Bratislava

E-mail: stehlikova@pc2.iam.fmph.uniba.sk

Web: http://www.iam.fmph.uniba.sk/institute/stehlikova/