Vasicek model II.

:: Maximum likelihood method and likelihood ratio test ::

-

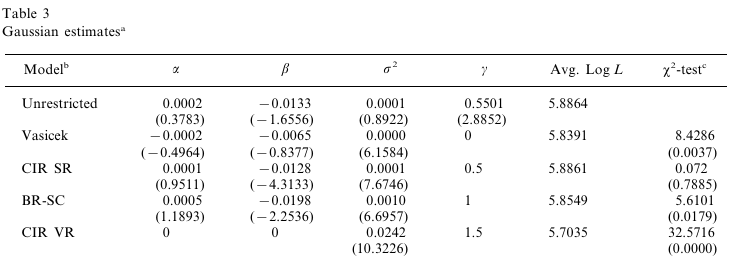

Again, we consider the CKLS model and its parametrization

from the paper (Episcopos, 2000), see Exercise 3 . We consider estimates for Germany which were obtained from 90 interest rate observtions.

Using the Average log likelihood values, compute the likelihood ratio test statistic and p-value for Vasicek and CIR VR models (see the table to see the restrictions in the latter case). Note that the results might be somewhat - but not much - different because of using rounded numbers.

- A similar approach was used in the paper K. Ben Nowman: Gaussian estimation of continuous time diffusions of UK interest rates,

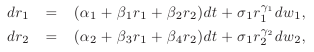

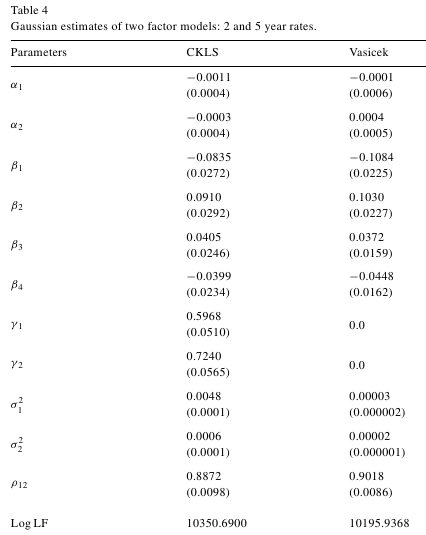

Mathematics and Computers in Simulation Volume 81, Issue 8, April 2011, pp. 1618-1624 where a pair of interest rate with different maturities we modelled by as system of SDEs (the increments of Wiener processes can be correlated, the correlation is a constant rho).

and estimated using maximum likelihood. Based on the resluts below (data: monthly data, Bank of England, 1/1970 - 3/2010), test the hypothesis that each of the rates can be modelled by a process with constant volatility.

:: Exercise ::

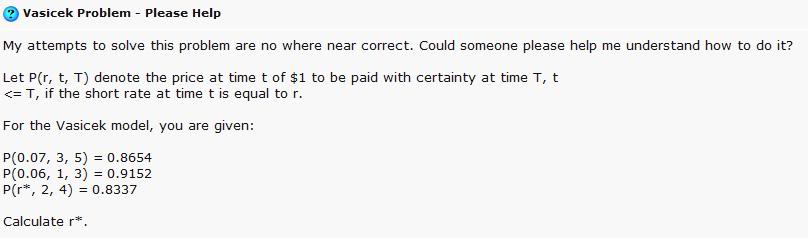

Vasicek model problem on an internet discussion forum:

Can you solve it?